In the financial world, loans play a critical role in helping individuals and businesses achieve their goals. However, understanding the different types of loans available is crucial for making informed financial decisions. Two of the most common types of loans are secured and unsecured loans, each with its unique characteristics, benefits, and drawbacks.

This article will explore the key differences between secured and unsecured loans, discussing what they are, their common types, advantages, disadvantages, and when to choose one over the other. By the end, you will have a comprehensive understanding of these lending options and will be better equipped to make the right choice for your financial needs.

What is a Secured Loan?

A secured loan is a type of borrowing that involves providing collateral to the lender. This collateral is typically an asset, such as a home, car, or other valuable property, that the lender can claim if the borrower fails to repay the loan as agreed. Due to the reduced risk for the lender, secured loans usually come with lower interest rates than their unsecured counterparts.

Borrowers often choose secured loans when they need to borrow a larger sum of money or when they may have a less-than-perfect credit score. Since the loan is backed by collateral, lenders may be more willing to provide funds even to those who may not qualify for unsecured loans.

Common Types of Secured Loans

Secured loans come in various forms, making them adaptable to different financial needs. Understanding the common types can help borrowers choose the most suitable option for their situation. Here are some of the most common types of secured loans:

1. **Home Equity Loans**: These loans allow homeowners to borrow against the equity they have built in their homes. They typically offer lower interest rates and are often used for significant expenses, such as home improvements or debt consolidation.

2. **Auto Loans**: Auto loans are a specific type of secured loan where the vehicle itself serves as collateral. This means if the borrower defaults, the lender can repossess the car.

- Mortgage Loans

- Boat Loans

- Personal Secured Loans

Each type of secured loan has its unique features and requirements, making it essential for potential borrowers to understand which option best suits their financial situation. It's crucial to consider factors such as interest rates, repayment terms, and fee structures when evaluating these loans.

Advantages of Secured Loans

Secured loans offer several advantages for borrowers. One of the most significant benefits is the lower interest rates compared to unsecured loans. Since these loans are backed by collateral, lenders perceive them as less risky and may provide more favorable terms as a result.

Additionally, secured loans may allow borrowers to access larger amounts of money than they might qualify for with unsecured loans. This can be particularly helpful for undertaking significant expenses like home renovations or medical bills, where greater funding is needed.

- Lower interest rates

- Access to larger amounts of money

- Potential for longer repayment terms

These advantages can make secured loans an attractive option for individuals looking to finance substantial purchases or investments. However, borrowers must approach these loans carefully, as the risks involved can have significant implications if repayment issues arise.

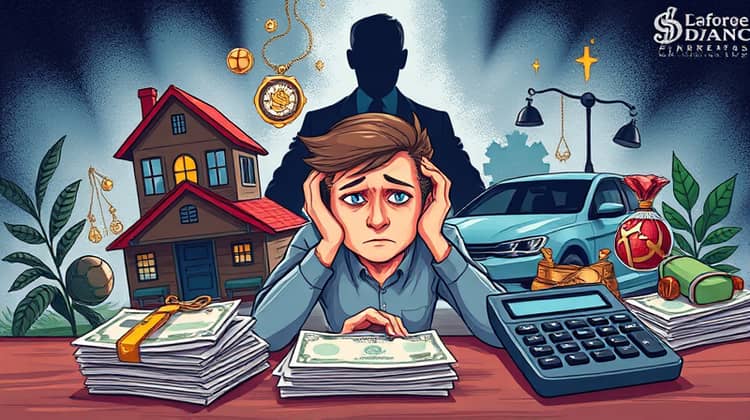

Disadvantages of Secured Loans

Despite the benefits, secured loans come with certain disadvantages that potential borrowers should consider. The most significant risk is the potential loss of collateral. If a borrower fails to repay the loan, the lender can seize the asset used as collateral, which can lead to significant financial and personal consequences.

Moreover, secured loans might come with additional fees and costs, such as appraisal fees, closing costs, or other charges that can add to the overall expense of borrowing. Borrowers need to thoroughly evaluate the total cost associated with secured loans before committing.

- Risk of losing collateral

- Additional fees and closing costs

- Longer processing times

Being aware of these drawbacks can help borrowers make more informed decisions about whether a secured loan is suitable for their financial situation. Hence, evaluating both the pros and cons is essential.

What is an Unsecured Loan?

Unsecured loans, unlike secured loans, do not require collateral. This means that borrowers do not have to pledge any assets to secure the loan, which can be appealing for those who are unwilling or unable to put their property on the line. However, because there is no collateral involved, unsecured loans typically come with higher interest rates, as lenders face a greater risk of non-repayment.

These loans are primarily based on the borrower's creditworthiness, making them more accessible for individuals with good credit scores. Unsecured loans can be used for various purposes, including personal expenses, debt consolidation, and business financing.

Common Types of Unsecured Loans

Unsecured loans are available in several forms, each catering to different borrower needs. Here are some common types:

- Personal Loans

- Credit Cards

- Student Loans

- Medical Loans

Understanding these common types of unsecured loans helps borrowers determine which one aligns best with their financial needs and objectives.

Advantages of Unsecured Loans

There are several advantages to unsecured loans that may make them a more attractive option for certain borrowers. One of the primary benefits is the lack of collateral requirement, which can provide peace of mind for borrowers who do not want to risk losing their assets in case they face repayment challenges.

Additionally, unsecured loans often have a quicker approval process compared to secured loans. This can be particularly beneficial for borrowers in urgent need of funds without the added time and hassle of appraisal or valuation processes related to collateral.

- No risk of losing collateral

- Faster application and approval process

- Flexibility of use for various purposes

Given these advantages, unsecured loans can be a viable option for individuals looking for financial assistance without the stress of securing their borrowing against valuable assets.

Disadvantages of Unsecured Loans

- Higher interest rates

- Strict credit requirements

- Lower borrowing limits

Key Differences Between Secured and Unsecured Loans

When comparing secured and unsecured loans, several key differences stand out. Understanding these distinctions can aid borrowers in determining which loan type best fits their needs and financial situation. One of the primary differences is the requirement of collateral; secured loans require an asset to back the loan, while unsecured loans do not.

Another critical difference lies in the loan terms and interest rates. Secured loans generally offer lower interest rates due to reduced risk for lenders, whereas unsecured loans typically come with higher rates due to the absence of collateral.

- Collateral Requirement

- Interest Rates

- Loan Amount Flexibility

- Repayment Terms

These differences significantly impact the borrower's decision-making process and should be taken into consideration when evaluating financing options.

When to Choose a Secured Loan

Choosing a secured loan may be the right decision for borrowers who seek lower interest rates and need to borrow a larger sum of money. This type of loan is ideal for financing significant expenses such as home renovations, purchasing a vehicle, or consolidating high-interest debts into a single lower-interest loan.

Additionally, individuals with lower credit scores may find it easier to qualify for secured loans, as the collateral provided can offset the lender's perceived risk. If you have valuable assets that you are willing to put at risk for the sake of obtaining a loan, this could be a suitable option for you.

When to Choose an Unsecured Loan

An unsecured loan may be the best option for individuals who do not want to put their assets at risk. If you have a strong credit history and prefer a loan that does not require collateral, then unsecured loans present a viable solution for various financial needs.

Unsecured loans are particularly recommended for smaller amounts, such as medical expenses, emergencies, or unexpected costs. If you require quick access to cash without lengthy processing times and extensive paperwork, unsecured loans are often easier and faster to obtain.

Conclusion

In conclusion, understanding the differences between secured and unsecured loans is vital for making informed financial decisions. By evaluating the specific benefits and drawbacks of each loan type, borrowers can select the option that best meets their financial needs and circumstances.

Whether you opt for a secured loan with its lower interest rates and higher borrowing limits or an unsecured loan with its ease of access and flexibility, ensuring your choice aligns with your financial goals is essential for successful borrowing.