As the cost of living continues to rise, many individuals find themselves struggling to manage their finances effectively. This often leads them into debt traps that can be difficult to escape. Understanding the warning signs is the first step in taking control of your financial situation and avoiding common pitfalls that result in overwhelming debt.

In this article, we will identify five key warning signs that indicate you may be falling into a debt trap. By recognizing these behaviors early, you can implement strategies to safeguard your finances and secure a more stable economic future.

1. Living Beyond Your Means

One of the most prevalent issues people face is living beyond their means. This occurs when your expenses exceed your income, leading to constant borrowing and debt accumulation.

Lifestyle inflation can make it tempting to spend more than you earn, but this is a surefire way to create financial instability.

- Frequent overspending on unnecessary items.

- Using credit cards for everyday purchases without a plan to pay them off.

- Taking on debt for luxuries instead of necessities.

Recognizing this behavior is crucial. Adjusting your spending habits and sticking to a budget are essential steps in reversing the trend of living beyond your means.

2. Lack of Savings

A lack of savings is a critical warning sign that you are potentially heading for financial trouble. Without a savings buffer, any unexpected expenses can throw you into a cycle of debt.

Building an emergency fund is an essential part of a stable financial life, but many individuals overlook this crucial element.

- No emergency savings fund set aside for unforeseen situations.

- Living paycheck to paycheck without a financial cushion.

- Forgetting to contribute to retirement or investment accounts.

Failure to save adequately can lead to having to rely on credit when the unexpected occurs, further entrenching you in debt. Consistently saving, even small amounts, can provide you the financial security you need.

3. Relying Heavily on Credit

Relying heavily on credit can lead to a dangerous cycle of debt. While credit cards can be a useful tool when managed wisely, using them as a crutch may indicate deeper financial issues.

If you consistently find yourself maxing out credit cards or relying on loans to cover basic living expenses, it’s time to reassess your financial strategies.

- Using credit cards to pay for day-to-day expenses without paying the balance.

- Consistent reliance on personal loans or payday loans as a regular source of income.

- Finding it challenging to afford necessary expenses without credit assistance.

Overreliance on credit suggests a lack of sufficient cash flow, which can lead to an unmanageable debt situation. Finding ways to reduce credit dependency is vital to preventing future financial issues.

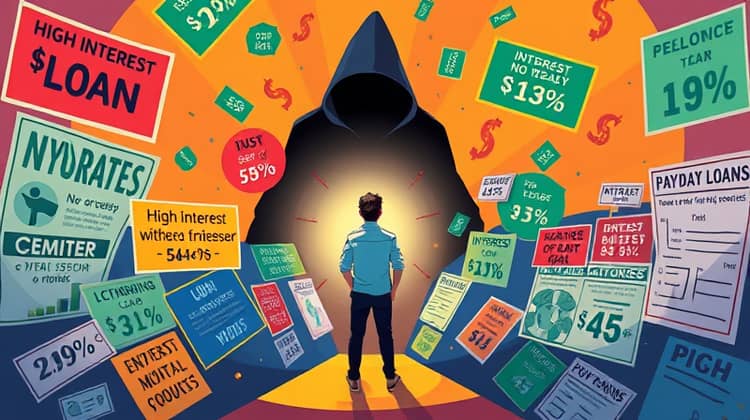

4. High-Interest Loans

High-interest loans, such as payday loans and cash advances, are significant red flags in any financial situation. While these options may provide quick money, they often come with exorbitant interest rates that can exacerbate your financial woes.

Borrowing through high-interest means you will end up paying much more than the initial amount borrowed, leading to a perpetual cycle of debt.

- Assess your current loan conditions.

- Evaluate the necessity of high-interest loans in your life.

- Explore alternatives like personal loans with lower interest rates.

Being mindful of the types of loans you are securing is crucial. Always seek the most favorable terms, and consider other available options that won't trap you in high borrowing costs.

5. Ignoring Financial Obligations

Ignoring your financial obligations can be tempting, especially if you feel overwhelmed. However, turning a blind eye to bills, loans, or credit card payments is a sure way to find yourself in a dire financial predicament.

This tactic only serves to accumulate debt and can result in severe long-term consequences, including damaged credit and legal issues.

- Keep track of all financial due dates.

- Communicate with lenders if you are struggling to meet payment obligations.

- Establishing a payment plan can help manage your debts more effectively.

Take your financial commitments seriously to maintain control over your budget. Being proactive about your obligations significantly contributes to your financial stability.

Taking Action to Avoid Debt Traps

Recognizing the warning signs is only the first step in avoiding debt traps; action must follow. Implementing practical strategies can help you break free from unhealthy financial habits and secure a more stable future.

Start making changes today by prioritizing your financial health and adhering to a budget that works for you.

- Create a monthly budget that covers all necessary expenses.

- Set financial goals and track your savings progress.

- Seek professional financial advice if you’re struggling to manage your debts.

Making proactive changes can significantly improve your financial outlook. By focusing on budgeting, saving, and managing your debt responsibly, you’ll enhance your financial security over time.

Remember, it’s never too late to start making positive financial decisions. The sooner you act to avoid these traps, the better off you’ll be in the long run.